Orientation & Fast Start

Before starting the fast start:

Verify Orientation Modules have been completed

Verify Telegram member

Goal of your fast start & training

Most people want to be financially independent, but they're missing two things:

A clear plan

A coach to guide them

That's where we come in.

Using a tool called the Financial Needs Analysis (or FNA for short), you'll learn to help clients identify gaps, create a path forward, and feel in control of their financial future.

Now imagine this...

If you did an FNA for 100 people:

How confident would you feel after the 100th one?

Out of 100, how many people do you think you could genuinely help?

How many referrals might those 100 people introduce you to?

Basically, the more people you help, the faster you'll grow.

Why else should I focus on doing 100 FNAs?

Simple answer: You build AUMs.

What are AUMs? Its really two things:

Assets Under Management

Agents Under Management

Assets Under Management

This represents the total value of investments you manage for your clients

It's the foundation for long-term, scalable, recurring income.

Why assets matter:

It creates a "floor" income and raises it year after year which creates stability and security

It's how you create freedom, flexibility, and financial independence for you and your clients

Milestone Goal: $50M AUM

Build a book of 100 new clients per year

Stay consistent until your personal AUM hits $50 million

After that point, your business will grow organically, through introductions, contributions, and market growth

Start now: even before your licensed

Our mission is to help you start growing your AUM from day 1

Once you're licensed, any investment clients you helped during training will be transferred to you.

$50 Million in AUM = $25,000 / month in recurring income. How would it feel to know your business keeps growing even when you're not working?

What's more powerful than helping 100 families on your own? Helping thousands by building a team of agents who do the same!

Agents Under Management

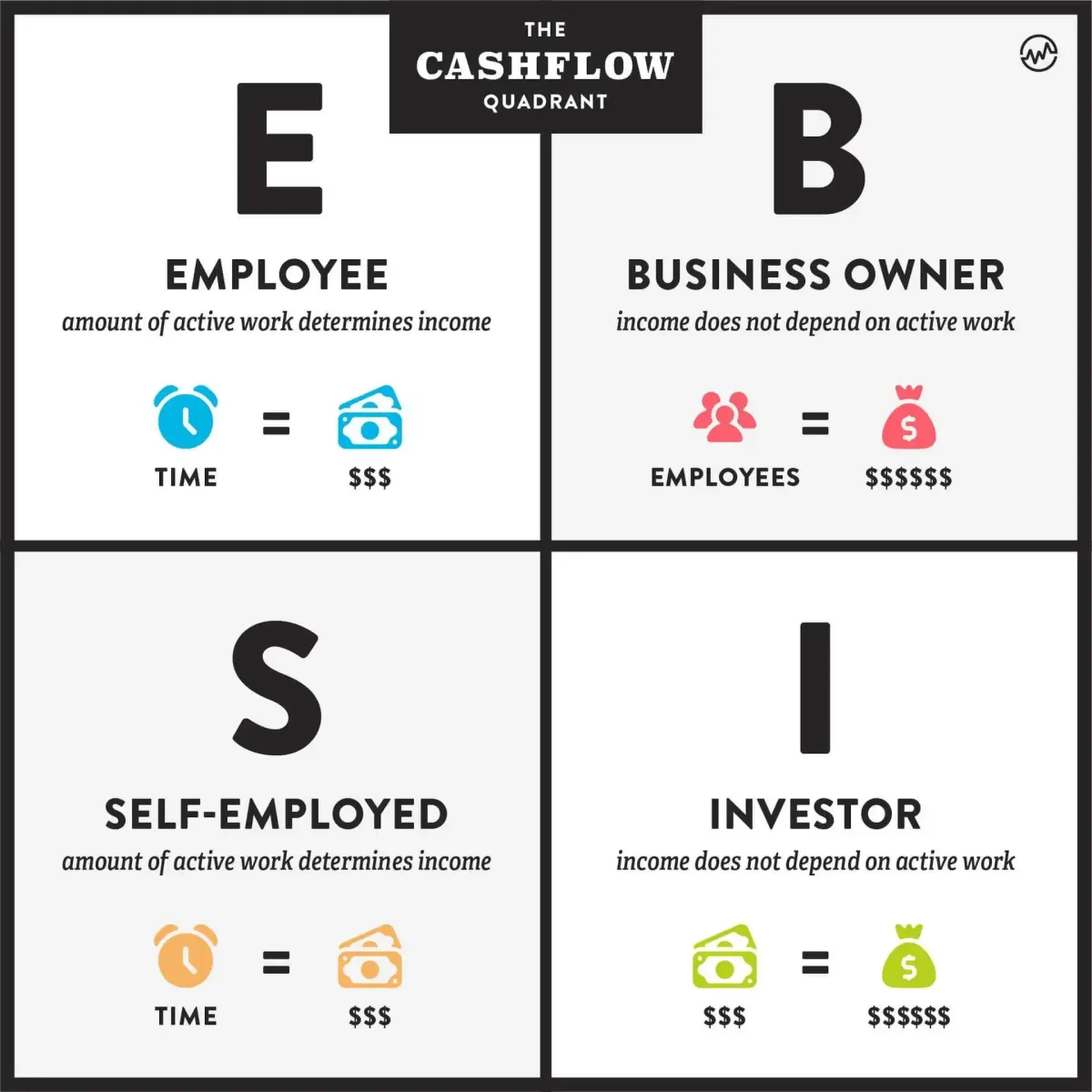

The cashflow quadrant teaches that true financial freedom comes from when you move from being an employee to building a business

Team overrides and recurring income continue to grow, even when you're not directly involved. Your teams growth multiplies your impact, income, and time freedom.

AUM (Assets Under Management) + AUM (Agents Under Management) = MPI (Massive Passive Income)

Finding Clients & Training

Let's talk about finding clients and training. In order to become a professional and master the business you'll be shadowing your trainer on appointments. So to set appointments we'll start with two proven strategies:

Relationship-based marketing

Social media marketing

Eventually all agents master several strategies to keep their calendar full.

Taking Action: Relationship-Based Marketing

Relationship-based marketing is the practice of using your existing connections to introduce your services in a natural, authentic way. It focuses on setting appointments that lead to long-term client with the people they introduce you too.

Existing connections include:

Hot Market: Family & close friends

Warm Market: Friends, acquaintances, and co-workers

Social Media

Those you know and have great credibility with are the best for:

Gaining experience

Getting your name out

Earning business and receiving referrals

Our goal is to have those you care about love what you do and be a walking billboard for you as you grow your business!

Some people we meet with will become clients, while others won't - either way you'll get experience. Great things come from showing as many people as possible what we do. So let's take action!

Taking Action

Create a list

Reach out & set a training appointment

Attend the training appointment

Taking Action: Social Media Marketing

Who: This post is marketing to those that are looking for work or a new opportunity

Why: There are two ways to market what we offer: (1) Income opportunity and (2) Financial Coaching.

Compared to marketing our products or financial guidance, marketing the opportunity to work with us spare-time, part-time or full-time gets a lot of activity and people reaching out interested in getting more details.

If you think about it, most everyone is looking for a career change, extra income, or know someone who does.

Marketing the income opportunity leads to:

A new agent

A client

Referrals

What: Producing leads from this social media approach will result in hiring meetings you're able to observe and be a part of a new agent's onboarding process!

How: We have several social media marketing strategies, but the first one we start with is posting to your Facebook/Instagram.

Let's walk through the steps!

The individuals identified as EmaJen Financial Solutions are affiliated with Primerica, and offer products and services through Primerica subsidiaries, including Primerica Life Insurance Company and PFS Investments Inc.

A Primerica representative’s ability to offer products and services is based on the licenses held by the individual, and the states in which the individual is registered. Not all representatives are authorized to sell all products and services. For additional information about a representative, including licenses and state registrations, please visit www.BrokerCheck.com.

PFS Investments Inc. (PFSI) offers both brokerage and advisory accounts. Representatives do not have investment discretion over any client account or assets. For additional information about the products and services available in brokerage and advisory accounts, including fees, expenses and the compensation received by PFSI and your representative, please review a copy of our Form CRS, Form ADV brochure and our informational brochure, Investing with Primerica, available from your representative and online at www.primerica.com/pfsidisclosures.

Securities offered by PFS Investments Inc. (PFSI), 1 Primerica Parkway, Duluth, Georgia 30099-0001, a broker-dealer and investment adviser registered with the Securities & Exchange Commission (SEC), a member of the Financial Regulatory Authority (FINRA) [www.finra.org] and a member of the Securities Investors Protection Corporation (SIPC) [www.sipc.com]. PFSI’s advisory business is conducted under the name Primerica Advisors. Fixed indexed annuities are offered by Primerica Financial Services, LLC (PFS). PFSI, PFS and Primerica Inc. are affiliated companies.

The Lifetime Investment Platform is an advisory program sponsored by PFS Investments under the name Primerica Advisors. For additional information about the program, please ask your representative for a copy of the Lifetime Investment Platform Form ADV brochure.

Investors should carefully consider the investment objectives, risks, charges, fees and expenses of any mutual fund before investing. This and other important information can be found in the fund’s prospectus and, if available, the summary prospectus. Please read the prospectus and, if available, the summary prospectus carefully before investing. Prospectuses are available from your Primerica representative.

Primerica representatives are not estate planners, or tax advisors. For related advice, individuals should consult an appropriately licensed professional.

This material is for informational purposes only and should not be considered investment advice or a recommendation to buy, sell or hold a security.

Investing entails risk including loss of principal. Past performance is no guarantee of future results.